|

The New York Times Editorial Board’s opinion on the recent e-book pricing court decision echoes the publishing industry’s longstanding position: “The big picture is that while Apple’s pact with the publishers raised prices in the short term, it also brought much-needed competition to the e-book marketplace. It is estimated that Apple now controls 10 percent of that market and Amazon 65 percent, with Barnes & Noble and others splitting the rest. That is healthier for the publishers and for consumers, too.” Underscoring the Times’ argument is a widely held, visceral conviction amongst publishers that Amazon’s growing share of the market for both paper and digital books has been bad for the industry, for consumers and even for society as a whole, given the hallowed role of the written word in our lives. However passionately held these beliefs are, they ultimately were deemed to hold little legal merit, as U.S. District Court Judge Denise Cote ruled decisively against Apple in the antitrust case — and by extension, against the publishers who had already settled to avoid mounting legal costs. While the penalty ruling has yet to be rendered, Judge Cote left no doubt that this case was not even a close call in her blistering 160 page opinion. “Apple and the Publisher Defendants shared one overarching interest that there be no price competition at the retail level. Apple did not want to compete with Amazon (or any other e-book retailer) on price; and the Publisher Defendants wanted to end Amazon’s $9.99 pricing and increase significantly the prevailing price point for e-books. With a full appreciation of each other’s interests, Apple and the Publisher Defendants agreed to work together to eliminate retail price competition in the e-book market and raise the price of e-books above $9.99.” While throughout this legal dispute, book publishers portrayed themselves as endangered curators of great literary work, what lies at the core of this case is the frightening reality that digital disruption of the book industry leaves publishers in a highly vulnerable and uncertain position. Even had Apple won this case on the publishers’ behalf (or prevails in its promised appeal), publishers will still need to figure out how to continue to add value in an environment where they no longer serve as the predominant gatekeeper, deciding which books get published, promoted and retailed to consumers. This is a legitimately scary concern, as exemplified by prior victims of technology-driven disintermediation, including Kodak, Blockbuster and Tower Records. So it is understandable that book publishers would seek legal relief from the inexorable erosion of their competitive position. But the ruling in this case was correct, in that accepting the position advocated by Apple, book publishers and the New York Times would require the willful suspension of belief in the intent of antitrust law and in the realities of free market competition as noted below:

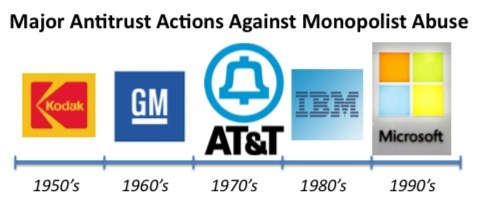

In the end, this anti-trust trial proved to be a slam-dunk case. The DOJ’s claims were backed up by damaging e-mails and phone logs establishing Apple’s and the publishers’ anti-competitive intent and by data that showed the incontrovertibly harmful consumer impact of their collusive behavior. The issue for Apple and publishers of course was never an overriding concern with what was best for consumers, but only what was best for them. This isn’t unusually callous behavior… it’s just business. Apple did not want to compete head on with Amazon in the retail market, and conspired with publishers who feared that Amazon would eventually demand lower wholesale prices, starting with e-books and eventually expanding to all books. To publishers, Amazon posed an existential threat. But the notion that publishers need to be exempted from broadly applicable antitrust constraints on collusive behavior to protect the status quo from the inevitable consequences of digital disruption, is an intellectually tenuous argument at best. The sad fact is that many aspiring authors would argue that the publishing industry has been retreating from its historically laudable role of promoting great literature and important non-fiction work long before the recent explosive growth in e-books. In this view, major publishing houses have generally made life harder for new and mid-list authors by collectively skewing their advances and marketing budgets towards blockbuster titles, often of dubious literary distinction. The logical corollary to this view is that the possibility of self-publishing e-books has opened more opportunities for more authors to get to market, giving more choice to consumers at lower prices. Some hard working, earnest (and often poorly paid) managers in the book publishing industry will undoubtedly take strong exception to this view of their noble profession and deeply believe that antitrust action -- if any — should have been brought against the monopolist evil empire in Seattle. But in the end, it is the marketplace and not the courts that will dictate the outcome of “the new normal” in the book publishing industry. If you have any doubt that even seemingly indomitable monopolists are not exempt from the need for continuous innovation and adaptive change with or without judicial restraint, consider the following. Each of the companies depicted below were accused at the height of their market power of monopolistic, antitrust behavior. Yet none of these companies were able to continue to dominate the industries in which they once held market shares of ~50% – 90+%. In the decades following government charges of antitrust abuses (some won, most lost), Kodak and GM went bankrupt, what was left of AT&T was sold off at a fire-sale price and IBM and Microsoft are no longer considered monopolist threats. More recently, Apple’s iTunes, which once looked invincible in the music download music business is now facing stiff competition from a number of streaming music providers, including Pandora, Spotify, Songza, Google and yes, even Amazon! So in the book industry, as in every other industry, every player — including Amazon — will have to continue to adapt their business models to deliver value in an industry subject to relentless change. Transient competitive advantages will come and go, but business outcomes will be ultimately be determined in the marketplace, not in the courts.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Len ShermanAfter 40 years in management consulting and venture capital, I joined the faculty of Columbia Business School, teaching courses in business strategy and corporate entrepreneurship Categories

All

Archives by title

How MIT Dragged Uber Through Public Relations Hell Is Softbank Uber's Savior? Why Can't Uber Make Money? Looking For Growth In All The Wrong Places Three Management Ideas That Need to Die Wells Fargo and the Lobster In the Pot Jumping to the Wrong Conclusions on the AT&T/Time Warner Merger What Kind Of Products Are You Really Selling? What Shakespeare Thinks About Brian Williams Are Customer-Friendly CEO’s Bad for Business? Uncharted Waters: What to Make Of Amazon’s Chronic Lack of Profits What Happens When David Becomes Goliath…Are Large Corporations Destined To Fail? Advice to Publishers: Don’t Fight For Your Honor, Fight For Your Lives! Amazon should be viewed as a fierce competitor in its dispute with publisher Hachette Men (And Women) Behaving Badly Why some brands “just don’t get no respect!” Courage and Faustian Bargains Sun Tzu and the Art of Disrupting Higher Education Nobody Cares What You Think! Product Complexity: Less Can Be More Apple's Product Strategy: No News Is Good News Willful Suspension of Belief In The Book Publishing Industry Whither Higher Education Timing Is Everything Teachable Moments -- The Curious Case of JC Penney What Dogs Can Teach Us About Business Are You Ready For Big-Bang Disruption? When Being Good Isn’t Good Enough Is Apple Losing Its Mojo? Blowing Up Old Habits What Is Apple's Product Strategy--Strategic Rigidity or Enlightened Expansion Strategic Inertia Strategic Alignment Strategic Clarity Archives by date

March 2018

|

Proudly powered by Weebly

RSS Feed

RSS Feed