|

In theory, effective business strategy is straightforwardly simple. The building blocks are strategic clarity and alignment:

A sage piece of investment advice is relevant in answering this question for established businesses. It has been suggested that when deciding whether to hold or sell a stock, it's useful to ask oneself: "would I buy the stock now if I didn't own it?" If the answer is yes, hold. If no, sell. What guidance does this advice provide to business managers about strategy? In a similar vein, managers should periodically ask themselves two questions:

But in fact, most companies trapped with outdated products and/or organizational capabilities fight to defend their losing hand, with predictably poor results. In short, too many executives are guilty of strategic inertia. Take the book publishing industry for example. Long after the Amazon Kindle had launched, when it was inescapably obvious that ebooks were going to be a major force in the industry, book publishing CEO's should have been asking themselves what new skills they needed to cultivate in their organizations and what new, enhanced products they needed to succeed in the post-digital industry. Instead, too many publishing execs took out their frustration with the growth of ebooks -- which they viewed as threatening their value proposition and price realization -- on consumers! How? First by selectively delaying the release of popular frontlist books in digital form and then engaging in a nasty, allegedly collusive price fixing fight with Amazon to impose a significant increase in ebook consumer prices. Early adopters of ebooks were amongst the most avid readers in the country -- the very customers book publishers should most want to serve. And yet, one Big Six publishing CEO, commenting on her company's decision to start delaying the release of best sellers in ebook form (which had been standard industry practice at the time) noted: "with new electronic readers coming and sales booming, we need to do this now, before the installed base of ebook reading devices gets to a size where doing it would be impossible." Unless your company is committed to continuously update your capabilities to deliver what consumers value, your strategy will not succeed in the long term. The proof that this is easier said than done is that so few companies succeed in sustaining long term profitable gro

0 Comments

In my last blog post, I noted the importance of strategic clarity, in terms of the ability of your company to articulate who you are selling to; what is the value proposition and how you can achieve competitive advantage in delivering designated products and services.

Easier said than done! But let's stipulate that your company has crystallized its strategy in these terms. The next step is to ensure you can capture the inherent value in your strategy through strategic alignment. Simply stated, strategic alignment is the development of a company's capabilities -- it's processes, operations, management systems and culture -- to uniquely support its strategy and desired value proposition. Here are a couple examples to break through the jargon. What do Southwest Airlines and BMW have in common? Very little actually, starting with distinctly different strategic priorities and value propositions. Southwest strives to deliver frequent, friendly reliable flights to price-sensitive leisure and business travelers at a cost others can't profitably match. BMW, on the other hand strives to deliver "ultimate driving machines" at a premium price that delivers value to a select segment of automotive enthusiasts. Each of these value propositions can be highly successful, but only if these companies align their core competencies to consistently, efficiently and effectively execute their chosen strategy. In Southwest's case, this entails highly standardized and simplified flight operations (e.g. one plane type, one class of service, no meals), industry leading labor relations to foster a service-oriented culture and highly disciplined management to avoid over-extending route coverage in this highly cyclical industry. The net result has been decades of extraordinary shareholder value growth, with no morale-killing layoffs in an industry where most legacy airline competitors have been in and (sometimes) out of bankruptcy. BMW on the other hand needs very different core competencies to support its distinctive strategic mission -- namely an organization that emphasizes R&D, state-of-the-art engineering and product development processes and a culture that encourages a commitment to best-in-class products. These are expensive capabilities to develop and maintain, but the company is explicitly investing to deliver value to a class of customer that is able and willing to pay a premium for consistently superior products. Companies that succeed in creating a tight linkage between their strategic intent and aligned capabilities are very difficult for competitors to copy. Sure, it’s easy for an airline competitor to temporarily slash fares to match Southwest, but unless they have the same underlying operational focus, organizational culture and management discipline, their cost structures will not allow a permanent low-fare position. Similarly, automotive competitors have run ads for years suggesting their products compare favorably with BMW (at a far lower price). But the marketplace has generally continued to recognize and reward BMW’s product excellence, despite its premium prices. In sound bite terms, it seems so simple: clearly articulate your strategy (who/what/how) and align all your capabilities to support superior execution. In my next post, I’ll opine on why so many companies struggle to meet these two strategic imperatives.  One of the early topics covered in my business strategy course at Columbia Business School is the importance of strategic clarity. Simply stated, the principle is that a prerequisite for sustained success is the ability of a company to clearly state its business strategy in terms of three defining building blocks:

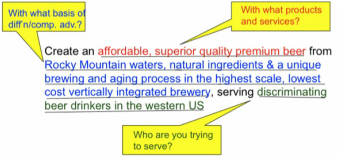

It sounds simple doesn't it? Most of my MBA students think so.... until we put the principle to a test. An excellent Harvard Business Review article on this topic entitled Can You Say What Your Strategy Is challenges companies to articulate their strategy in terms of the elements above in 35 words or less. Why reduce strategic intent to a tweet? Because it stress tests whether your company truly does have strategic clarity that can be easily understood (and hopefully embraced) by your shareholders, employees and customers. In our class, students are asked to articulate the business strategy of the Coors beer company in the 1970's and contrast it to the company's apparent strategy today. What emerges is that:

For what it's worth, here's the school solution on Coors' mid-1970s strategy in 35 words (minus the financial objective, which wasn't disclosed in the case study reading): While obviously, even the most well conceived statement of business strategy still needs to be effectively executed, strategic clarity is a prerequisite to success. To demonstrate the relevance of strategic clarity, try this at home: think of the the three best and least well managed companies that first come to your mind. Now ask yourself, which group of companies appears to have a clearer, more "tweetable" business strategy? How about your company? Can you tweet the essence of your business strategy that makes a compelling case for how and why you will win in the marketplace? |

Len ShermanAfter 40 years in management consulting and venture capital, I joined the faculty of Columbia Business School, teaching courses in business strategy and corporate entrepreneurship Categories

All

Archives by title

How MIT Dragged Uber Through Public Relations Hell Is Softbank Uber's Savior? Why Can't Uber Make Money? Looking For Growth In All The Wrong Places Three Management Ideas That Need to Die Wells Fargo and the Lobster In the Pot Jumping to the Wrong Conclusions on the AT&T/Time Warner Merger What Kind Of Products Are You Really Selling? What Shakespeare Thinks About Brian Williams Are Customer-Friendly CEO’s Bad for Business? Uncharted Waters: What to Make Of Amazon’s Chronic Lack of Profits What Happens When David Becomes Goliath…Are Large Corporations Destined To Fail? Advice to Publishers: Don’t Fight For Your Honor, Fight For Your Lives! Amazon should be viewed as a fierce competitor in its dispute with publisher Hachette Men (And Women) Behaving Badly Why some brands “just don’t get no respect!” Courage and Faustian Bargains Sun Tzu and the Art of Disrupting Higher Education Nobody Cares What You Think! Product Complexity: Less Can Be More Apple's Product Strategy: No News Is Good News Willful Suspension of Belief In The Book Publishing Industry Whither Higher Education Timing Is Everything Teachable Moments -- The Curious Case of JC Penney What Dogs Can Teach Us About Business Are You Ready For Big-Bang Disruption? When Being Good Isn’t Good Enough Is Apple Losing Its Mojo? Blowing Up Old Habits What Is Apple's Product Strategy--Strategic Rigidity or Enlightened Expansion Strategic Inertia Strategic Alignment Strategic Clarity Archives by date

March 2018

|

Proudly powered by Weebly

RSS Feed

RSS Feed