|

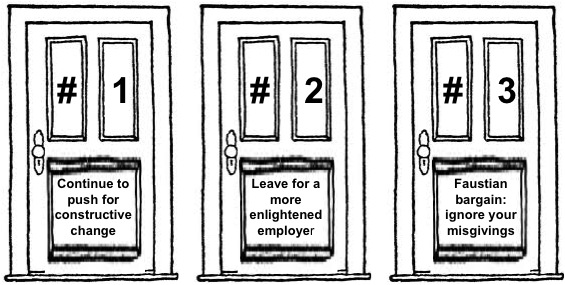

A recurring theme in my MBA course on business strategy this semester was courage. Executives need courage to create breakaway products that offer consumers a compelling value proposition in ways that are meaningfully different from competition. Such executives are not afraid to break from competitive norms; to go beyond the safe boundaries of incremental improvements. Think Tesla, Post-It Notes, Swiffer and Ikea. And executives also need courage to go all-in in ensuring that the company’s resources, assets and management incentives are fully aligned to support the breakaway strategy. Such executives become personally vested in, and identified with their business strategy, earning justified glory or job-ending rebuke, depending on outcomes. Think Nicolas Hayek at Swatch, Steve Jobs (second time around) at Apple and Dave Barger at jetBlue. The products and executives cited above provide inspirational stories of creative leadership, driven by leaders who live by the credo of “no guts, no glory.” But what are the implications for MBA graduates most of whom are about to enter the corporate workforce in entry level positions? They are not initially in a position to exert courageous leadership. Or are they? A guest speaker in my class near the end of the semester — entrepreneur, author, blogger Seth Godin — urged my students to approach their first (and every) job with the mindset to “make a ruckus” and “don’t be afraid to be fired.” In short, Godin was rendering themes from my course in very personal terms. Customer centricity and playing to win (as opposed to playing not to lose) are not just mantras for corporate leaders, but a code for all to live by. Now it’s easy for financially secure elders like Godin and myself to proselytize a message of personal leadership, driven by the principles of effective strategy without fear of rocking the boat. But what if you’re just feeling your way around a new job in a new company whose paycheck is critical to repairing your post-MBA balance sheet? How and where do you draw the line between pushing for constructive change and being a good team player in supporting your company’s current business direction? My short answer is there is no hard line, it’s a decidedly personal decision, but nevercompromise being honest with yourself about what you’re doing and why. It’s quite natural for students to approach their first post-MBA job with a combination of optimism and excitement. But once on board, what would you do if you find yourself becoming concerned and ultimately convinced that your company is headed in the wrong direction? You have three choices:

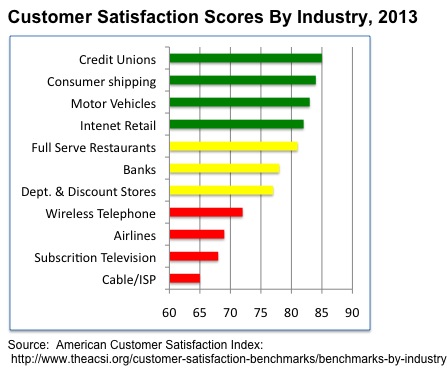

Here’s a hypothetical example to put this question to the test. Suppose you accept the premise that strategy should be formulated from an “outside-in” perspective — that is, the highest priority being to create and consistently deliver a compelling consumer value proposition. Internal capabilities, incentives and corporate policies should be aligned and managed towards supporting this end. That all sounds reasonable enough, but the reality is that companies vary widely in their commitment to operate in such a fashion. Watch what companies do, not what they say. Every company says that they value their customers, but there is a wide variance in perceived customer satisfaction across industries to suggest otherwise. For example, the exhibit below displays 2013 results from ACSI, a spinout from the University of Michigan, on customer satisfaction by industry on a 0-100 index scale. You probably shouldn’t be surprised to see that companies in the red zone — broadband/ISPs (e.g. Comcast), subscription television (e.g. Time Warner), airlines (e.g. United) and wireless telephone providers (e.g. AT&T Mobility) score quite poorly in delivering an appealing customer experience. There are a few bright spots (e.g. jetBlue), but by and large, companies in these industries have knowingly implemented business practices that extract revenue in ways that aggravate their customers. Now suppose you were hired in as a freshly minted MBA to manage Policy Assessment and Strategy for the Customer Service Group of one of the lower performing companies in one of these industries. After a few months into the job, with due diligence under your belt from proprietary company surveys, auditing customer service calls and internal management interviews, you report your initial findings to your boss. For starters, you confidently summarize what you believe to be the root causes of your company’s chronically poor customer satisfaction performance:

With MBA case studies still fresh in your mind on the success of truly customer-centric companies, you object, noting that focusing only on post-transaction customer complaints is inherently self-limiting and will ultimately reduce lifetime customer value. But your boss adamantly asserts that corporate management is well aware of the frequency and source of complaints received by customer service, and “they’ve done their homework to determine the profit-maximizing business model.” You’re tempted to press further — questioning the time frame for the analysis, or whether customer churn impacts have been fully incorporated in the analysis — but your boss’ mien signals this conversation is over, at least for now. So now what? You’ve essentially been asked to put lipstick on a pig, whose behavior is largely outside your control. You hopefully should get the opportunity to revisit your company’s broader business strategy questions, after having more time to gather evidence, to substantiate your recommendations and to get more savvy about internal politics. But the the possibility — and likelihood, given your current position in the company — still remains that you will be unable to instigate a personally satisfying course correction in the company’s strategy. Let’s say you’ve been at it for sixteen months, and it’s time to revisit doors #1, #2 and #3.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Len ShermanAfter 40 years in management consulting and venture capital, I joined the faculty of Columbia Business School, teaching courses in business strategy and corporate entrepreneurship Categories

All

Archives by title

How MIT Dragged Uber Through Public Relations Hell Is Softbank Uber's Savior? Why Can't Uber Make Money? Looking For Growth In All The Wrong Places Three Management Ideas That Need to Die Wells Fargo and the Lobster In the Pot Jumping to the Wrong Conclusions on the AT&T/Time Warner Merger What Kind Of Products Are You Really Selling? What Shakespeare Thinks About Brian Williams Are Customer-Friendly CEO’s Bad for Business? Uncharted Waters: What to Make Of Amazon’s Chronic Lack of Profits What Happens When David Becomes Goliath…Are Large Corporations Destined To Fail? Advice to Publishers: Don’t Fight For Your Honor, Fight For Your Lives! Amazon should be viewed as a fierce competitor in its dispute with publisher Hachette Men (And Women) Behaving Badly Why some brands “just don’t get no respect!” Courage and Faustian Bargains Sun Tzu and the Art of Disrupting Higher Education Nobody Cares What You Think! Product Complexity: Less Can Be More Apple's Product Strategy: No News Is Good News Willful Suspension of Belief In The Book Publishing Industry Whither Higher Education Timing Is Everything Teachable Moments -- The Curious Case of JC Penney What Dogs Can Teach Us About Business Are You Ready For Big-Bang Disruption? When Being Good Isn’t Good Enough Is Apple Losing Its Mojo? Blowing Up Old Habits What Is Apple's Product Strategy--Strategic Rigidity or Enlightened Expansion Strategic Inertia Strategic Alignment Strategic Clarity Archives by date

March 2018

|

Proudly powered by Weebly

RSS Feed

RSS Feed