Let’s be clear; the world does not need another article pounding Ron Johnson for his ignominious fall from grace. And so I won’t. Except to use this painful episode as a “teachable moment,” rather than just gratuitous schadenfreude. So what have we learned from JCP’s failed strategy? In broadest strokes, it’s that a strategy flawed in both concept and execution has little chance to succeed. Let’s start with a reminder that JCP had to do something to change its game, which is why the Board reached out to a proven executive who had helped transform retailing at Target and Apple. Prior to Johnson’s arrival, JCP had become the somewhat dreary champion of promotion-driven selling, with predictably damaging impacts on the company’s financial performance and image .

By all accounts, Johnson is smart, hard working and decisive and it didn’t take long for the new CEO to stake out a bold and transformative strategy, defined by three major initiatives:

So let’s try throwing Johnson another lifeline. We’ve already noted that Johnson had to take bold, imaginative action. And he’s certainly not alone in radically transforming a sick company by aggressively rolling out an ambitious but largely untested strategy. For example, nearly thirty years ago, Nicolas Hayek raced to implement a national rollout of Swatch in the US, ignoring pilot tests indicating little consumer interest in his boldly fashioned creations from Switzerland. And of course Steve Jobs was famously dismissive about the need for market research or pilot tests before launching massive rollouts of the iPod/iPhone/Tablet. Needless to say, Swatch’s and Apple’s product launches achieved runaway and enduring success. And Ron Johnson was there, at Apple, close to the throne of the master! So little wonder that Johnson would take a page out of Steve Jobs’ (and Hayek’s) playbook to transform JCP by going bold, going big and going fast!! So why are Jobs and Hayek regarded as geniuses and Johnson a goat? Was Johnson just unlucky? On the other hand, maybe Jobs and Hayek were just lucky, and not deserving of their reverential acclaim. Bad luck or bad strategy; which is it? I’ve run out of lifelines and can no longer cut Johnson any more slack. The reality is strategy iscontextual. The fact that a particular strategy worked well in one context most assuredly does not mean that it will thrive in another. There are profound differences between the circumstances surrounding the launches of Swatch and Apple’s innovative consumer entries that simply don’t carry over to JCP’s situation. An understanding of these differences — had JCP taken the time to think it through — would have indicated ex ante that JCP’s commitment to a rapid national rollout of an untested strategy was unwise, unnecessary and breathtakingly risky. Let’s take the flaws in Johnson’s strategy one at a time. 1. The company never demonstrated compelling evidence that JCP’s customers were clamoring for its new strategy; and relatedly, JCP did not or could not articulate the benefits of its strategy in terms that were easily understood by its customers What made JCP think that its consumers hated sales promotions? After all JCP had trained their consumers for over 100 years to expect items on sale. One could surmise that JCP catered predominantly to “bargain hunters” for whom finding an unexpected bargain was part of a game that its customers felt they could always win at JCP. Ron Johnson changed the rules of a game that too many of his customer were enjoying and winning. As same store sales stats soon confirmed, customers either didn’t understand or didn’t like “fair and square pricing”. Either way, they voted with their feet and not their pocketbooks to shop elsewhere. So what is “fair and square pricing?” I put this question to my MBA class this week, and as expected found that JCP had done a poor job clearly communicating its structure and intent. One student correctly suggested that “it had something to do with less reliance on sales promotions.” Fair enough, but to be effective, JCP had to not only say what they were not going to do, but also to clearly explain what made “fair and square” better than what consumers had become accustomed or at least inured to for decades. And on that score “fair and square” pricing turns out to be pretty complicated and confusing. Here’s a primer:

In contrast, consider Swatch’s launch strategy which also was seeking to create a brand centered around value and style. With the acknowledgement that transparent pricing is easier to implement in a company with a few dozen rather than a few thousand SKU’s, here’s Swatch’s pricing approach: All watches — no matter how popular, no matter how new to market, and no matter what rock star designer inspired the creation — will be priced at $40. And that same $40 price tag will stay in force not for one month, or for one year, but for a decade. The same simple price strategy extended around the world, with prices set at 60 DM in Germany and 7,000 Yen in Japan. That’s how you create a brand that meaningfully conveys style and value! One could also argue that by moving its merchandise focus upscale, further away from Sears and WalMart, JCP was distancing themselves from their core customer base in search of new clientele already well served by brands well known for higher quality merchandise — e.g. Macy’s, Bloomingdales and Target. Along with the new pricing scheme, did the JCP really think it its new merchandising strategy would gain more new customers than it risked losing during their strategic transition? Apparently so. 2. JCP raced to implement its strategy on a national scale with no regional pilots to iteratively test and refine new concepts As already noted, there are some inspirational examples of companies that also made big bets on untested big bang launches that paid off. So why pick on JCP on this score? The companies cited earlier operated under three profoundly different circumstances that do not apply to JCP.

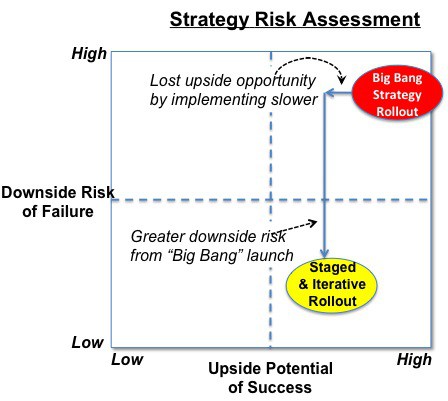

JCP was fighting for current market share within a well defined industry structure, not creating new markets. It’s strategic direction clearly risked alienating its current core customers, and there was no particular reason that the strategy would have been seriously compromised by a more deliberate and staged implementation incorporating testing and iterative refinement. After all, one could argue that Macy’s, Bloomingdales and Target were already occupying the very same space JCP was trying to break into, so there was nothing particularly shocking or new about their brand aspiration. Given JCP’s strategic context, Ron Johnson’s strategy reflected exceptionally poor risk management. Ask yourself this: did the upside potential of a big bang success more than offset the downside risk of failure? As viewed in this risk/reward assessment grid, the answer is decidedly not! Lessons Learned As a parting shot, two salient lessons learned emerge from the JCP story.

We’ll never know whether Ron Johnson’s strategy would have eventually proved itself in the marketplace, but we do that he ended his career with a bang and unnecessarily put his company in grave peril.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Len ShermanAfter 40 years in management consulting and venture capital, I joined the faculty of Columbia Business School, teaching courses in business strategy and corporate entrepreneurship Categories

All

Archives by title

How MIT Dragged Uber Through Public Relations Hell Is Softbank Uber's Savior? Why Can't Uber Make Money? Looking For Growth In All The Wrong Places Three Management Ideas That Need to Die Wells Fargo and the Lobster In the Pot Jumping to the Wrong Conclusions on the AT&T/Time Warner Merger What Kind Of Products Are You Really Selling? What Shakespeare Thinks About Brian Williams Are Customer-Friendly CEO’s Bad for Business? Uncharted Waters: What to Make Of Amazon’s Chronic Lack of Profits What Happens When David Becomes Goliath…Are Large Corporations Destined To Fail? Advice to Publishers: Don’t Fight For Your Honor, Fight For Your Lives! Amazon should be viewed as a fierce competitor in its dispute with publisher Hachette Men (And Women) Behaving Badly Why some brands “just don’t get no respect!” Courage and Faustian Bargains Sun Tzu and the Art of Disrupting Higher Education Nobody Cares What You Think! Product Complexity: Less Can Be More Apple's Product Strategy: No News Is Good News Willful Suspension of Belief In The Book Publishing Industry Whither Higher Education Timing Is Everything Teachable Moments -- The Curious Case of JC Penney What Dogs Can Teach Us About Business Are You Ready For Big-Bang Disruption? When Being Good Isn’t Good Enough Is Apple Losing Its Mojo? Blowing Up Old Habits What Is Apple's Product Strategy--Strategic Rigidity or Enlightened Expansion Strategic Inertia Strategic Alignment Strategic Clarity Archives by date

March 2018

|

Proudly powered by Weebly

RSS Feed

RSS Feed