|

There is a bitingly funny line in the 2007 movie The Bucket List in which Jack Nicholson’s character (a self-made billionaire) responds to a heartfelt compliment from his loyal business manager with the ultimate putdown: “Nobody cares what you think!“. Later in the movie, Nicholson smacks down his assistant yet again with the zinger: “I’d really like to say you’re irreplaceable, but I’d be lying.”  We laugh at such gratuitous boorishness, knowing of course that if we were the object of such scorn, it would be devastatingly hurtful. Cringe-worthy behavior has been a Nicholson comedic staple for decades. There’s an interesting backstory here with serious business implications. Critics were quick to bury The Bucket List with every pejorative in their Thesaurus when it first came out: “preposterous” (NY Times), “cheap and flimsy” (Miami Herald) and “a cloying … lazy low-grade product” (Seattle Times). But despite the critics’ scorn, The Bucket List went on to become an audience favorite, topping box office charts for weeks and grossing >$175 million for Warner Brothers. Moviegoers were in essence thumbing their nose at critics and telling them: “nobody cares what you think!” The declining relevance of movie critics underscores a broader shift transforming many industries: technology-enabled self empowerment. Think about it. The underlying value proposition for most companies is to sell a product or service that is too too complex, inconvenient or expensive for consumers to provide on their own. In this regard, consumers have historically been willing to pay movie critics (indirectly through their newspaper and television subscriptions or advertising eyeballs) for the valuable service of previewing and critiquing new film releases. But the internet has now created a platform for everyone to be a movie critic, and many moviegoers consider the “wisdom of the crowds” on sites like Rotten Tomatoes to be a more reliable guide, particularly if one can filter reviews to reflect individual preferences, as with Netflix’ and Amazon’s recommendation engines. Social network “Likes” have added yet another preferred alternative to the need for putative expert critics. Technology-enabled self empowerment has or is ravaging a number of other industries, including:

All the news that’s fit to print For historical industry leaders whose value proposition has been undermined by these disruptive technologies, the financial and emotional impact is no laughing matter. When customers begin in essence telling legacy market leaders that they no longer care what the company thinks (or sells), it’s terrifying. Take the New York Times for example. In 1896, the Times started carrying an iconic text box atop its front page embodying the hubris of a company laying claim to “All The News That’s Fit To Print.” During the ensuing 100 years, the Times had good reason to assume that consumers could not possibly serve as their own editors in ferreting out important news stories from around the globe. But in the post-internet era, a bevy of customizable search-driven applications now self-empower consumers to access news from a wide range of news sources and political viewpoints, including easy access to topics of personal interest that the Times maynot view as fit to print. Add to that the emergence of Twitter, which has often become the first to break current events, and it’s clear that the Times is now competing for customer attention in a very different world. What’s a company to do when their basis of competitive advantage that has served them so well for decades is severely undermined? Unfortunately, the most common initial reaction is paralyzing denial, fear and anger. What follows next ultimately determines whether a disrupted company can adapt and survive (possibly in smaller but sustainable form) or fail. IBM provides a good example of a company that not only survived but prospered after new technologies decimated their once-dominant mainframe computer business. After teetering on the edge of bankruptcy in the early 1990s, IBM shifted its business mix through acquisitions towards IT services, outsourcing and software to emerge as a stronger, considerably larger and more diversified company. Disruption has been far less kind to hundreds of brick and mortar travel agencies who were flattened by the rapid rise of online travel services. So how has the New York Times fared? To their credit, after experiencing early fear, uncertainty and doubt, the New York Times worked hard to remain relevant in the post-online news era. The company has pioneered a number of innovative online news features and successfully implemented the largest general newspaper paywall in the industry to supplement its profitable but steadily declining print newspaper business. While the internet has not been kind to its bottom line, online access has broadened the Times’ print audience reach by more than 25X. In Jack Nicholson’s parlance, more people than ever care what the New York Times thinks, albeit neither readers nor advertisers are willing to pay very much for the privilege. Revenues at the NY Times have declined 40% over the past six years, but the company has downsized sufficiently to secure a profitable future. Turmoil in the book industry The situation is a bit murkier for book publishers and booksellers, who are losing relevance (and financial viability) in a market increasingly driven by online purchases of paper and digital books. Technology self-empowerment is at play throughout the book publishing value chain, allowing authors to get to market without traditional publishers and readers to purchase books without bookstores. Reflecting the shift in bargaining power, one “Big 6” publishing executive recently told me: “it used to be that aspiring authors would damn near kill to be picked up by a major publishing house; now authors with self-publishing experience under their belt come to me with the question ‘what can you do for me?!'” In response, a number of traditional booksellers and publishing executives have reacted by decrying Amazon’s growing disruptive influence as evil, unfair and bad for society. In support of this view, publishing executives often note that their editorial prowess has helped bring great literature to market that might otherwise have never taken form. And booksellers are quick to point out their pivotal role in curating, displaying and recommending great reads to help struggling authors reach customers who would otherwise be unaware of promising new works. The problem with such arguments is that those dislodged by innovation in the book industry are conflating their own welfare with the marketplace as a whole. The fact is, more books are being written and read than ever before through channels which bypass the traditional book publishing industry value chain.

It is certainly true that talented editors working on behalf of traditional publishers have helped identify, refine and promote great literary works that have had considerable cultural impact. As cases in point, kudos to J. B. Lippincott who worked intensively with first time author Harper Lee in crafting the wildly successful To Kill a Mockingbird. Knopf’s role in bringing Julia Child’s masterpiece, Mastering The Art of French Cooking to market is another legendary publishing success story . And of course, Bloomsbury hit the financial jackpot when it took a flyer in 1997 on an unknown rookie children’s book writer named JK Rowling. But it’s important to note that each of these rock star authors was initially rejected by ten or more publishers before finally finding a gatekeeper — aka publisher — who allowed their work to get to market. For every Lee, Child or Rowling that was discovered in the pre-digital book era, there are scores of other great writers who lacked the luck, connections and/or perseverance to get their books published. These stories were never told. The gatekeeper role of publishers has changed of course in the post-digital book world where now any author can choose to self-publish an e-book or print-on-demand version with very little investment, and consumers can find promising new works by searching for topics of individual interest or by checking personalized wisdom-of-the-crowds recommendations on sites like Amazon or Goodreads. What does this mean for book publishers and booksellers? Book publishers will need to master new digital content skills to remain relevant in the post-digital market, offering authors a range of services that arguably can increase sales of books in multiple formats. For example, Atria Books, an imprint of Simon & Schuster recently publishedA Swing for Life by Nick Faldo, incorporating QR codes in the hardcover version, enabling consumers to view instructional golf videos on mobile devices. This tome is also available as an e-book, where multi-media clips are embedded directly in the text. Expect to see more multi-media, multiple format initiatives from traditional publishers and new entrants in the years ahead. There is also a continuing role for traditional booksellers provided that they restructure to the realities of a smaller base of loyal customers willing to pay higher prices for valued attributes. For example, Powell’s City of Books in Portland, Ore., has maintained an evangelistic core of customers enamored of the ambiance and expertise of their local bookseller, despite higher prices than charged by Amazon. Coda Companies that don’t want consumers to stop caring what they think or sell (and who doesn’t!) had better be prepared to continuously respond to shifts in how consumers prefer to get jobs done. While we can chuckle at Jack Nicholson at the movies, this is no laughing matter for incumbents in industries undergoing technology-enabled self empowerment. Many other industries are facing similar challenges, including higher education, routine medical services and licensed taxi operators. Is your company next?

2 Comments

Imagine you’re a brand manager for a consumer packaged goods product, clawing for tenths of a percent of market share against aggressive national and store-brand competitors. The pressure to add product line extensions are constant and seemingly compelling:

Examples of product line proliferation abound:

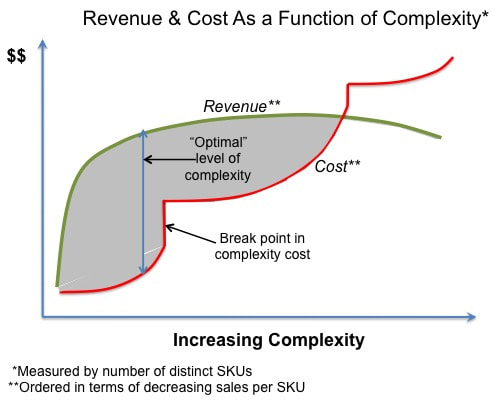

The tech sector also often falls prey to allowing excessive product-line complexity to weaken brand images and value propositions, as exemplified by Evernote. Founded in 2008, Evernote is a cross-platform, “freemium” app designed for note taking and organizing and archiving personal information. In other words, Evernote is designed to help individuals and work teams store and retrieve any information in any format on whatever devices they happen to be working on. By 2013, the company seemed to be on a roll; it had registered eighty million users and attracted over $300 million in investment from venture capitalists who valued the company at one billion dollars. But over the next two years, the company ran into trouble. In 2015, Evernote laid off nearly 20 percent of its workforce, shut down three of its ten global offices and replaced its CEO. It turns out that the vast majority of Evernote’s users only signed up for the free app and didn’t see enough value to upgrade to a paid subscription. Struggling to generate revenue, Evernote lost its focus and continuously released new products that added complexity, and often performed poorly. The company developed so many features and functions that it became increasingly difficult to explain to newcomers or even veteran users exactly what the product was. As Evernote’s former CEO Phil Libin explained, “people go and they say, ‘Oh, I love Evernote. I’ve been using it for years and now I realize I’ve only been using it for 5 percent of what it can do.’ And the problem is that it’s a different 5 percent for everyone. If everyone just found the same 5 percent, then we’d just cut the other 95 percent and save ourselves a lot of money. It’s a very broad usage base. And we need to be a lot better about tying it together.” Evernote wound up spreading itself too thin and lost sight of its core identity and primary consumer value proposition. To avoid this common management trap, let’s pause for a reality check on the true impacts of product complexity. The harsh reality is, the vast majority of product line extensions do not make financial sense. Virtually every management consulting company has an online white paper outlining their approach to dealing with the problem of excessive product line complexity. Try Googling “Product Complexity + _______” and you’ll see what I mean from McKinsey, BCG, Bain, Booz, Accenture, AT Kearney , Roland Berger et al. Academics have also weighed in with innumerable scholarly studies on the same issue. If you’re not familiar with the literature, I’ll spare you the effort by recounting four main takeaways:

These solutions are analytically elegant, mathematically precise and rigorously prescriptive. Have the quants really provided an viable approach to avoid the pervasive challenge of excess product line complexity? Actually, no. The problem is that these efforts typically treat the symptoms but not the root cause of excessive product line complexity. Unless companies address the underlying drivers of bloated product lines, they are likely to slip back into bad habits after a crash complexity reduction initiative. Not unlike yo-yo diets, when it comes to excessive product line complexity, recidivism rates are quite high. Moreover, technocratic solutions to optimize SKU counts overlook the profoundly more important link between product line complexity and overall business strategy. Both these points warrant explanation. Why do companies tend to add too much product line complexity? Marketing professionals pride themselves on their creativity and responsiveness to evolving customer needs. The urge to pursue new market opportunities and/or to respond to competitive threats are considered hallmarks of strong management. Consider for example the following rationales a brand manager might use to justify product line extensions:

Fundamental strategic choice: broad market coverage vs. targeted distinctiveness By this rationale, Apple should have responded to Samsung’s introduction of a large screen smartphone a long time ago. And Chipotle should have added a breakfast burrito. And In-N-Out Burger should have tried to appeal to new customers with a variety chicken, fish, egg and sausage menu items. What’s wrong with these companies?! Each of these companies has made a concerted choice to limit the range of merchandise they bring to market, focusing instead on delivering dominantly superior products in selected categories. Limiting product complexity thus lies at the very core of these companies’ business strategy. Their success — each has significantly outperformed sector competition — is driven as much by what they are NOT willing to do as by what they are willing to pursue. Take In-N-Out Burger for example. When is the last time you heard anyone rave about the taste of McDonald’s cheeseburgers in the same reverential terms as In-N-Out’s customer evangelists? Why is that? On the surface, both fast food chains are selling similar products at similar price points. But In-N-Out burgers taste better because:

Unlike In-N-Out, whose only entrée is hamburgers, and who restricts store hours to reflect minimal menu offerings and who limits geographic coverage to territories where the quality of locally sourced food items can be strictly controlled , McDonalds has chosen to compete on the basis a broad menu choice, global store ubiquity and extended service hours (often 24X7). But carrying such a wide array of food products around the globe complicates McDonalds’ logistics and service operations, requiring bulk shipments of frozen food products, in-store freezers, and pre-cooked orders kept warm by heat lamps in each establishment. The resulting quality differences are very real, dictated by structural differences in the underlying product line strategies. This isn’t a case of a right vs. wrong strategy (both have been successful), but simply a reflection of two companies that have chosen to compete on very different terms. The fact remains, product complexity DOES affect quality, and the choice of ever-expanding line extensions is never without adverse consequences. Chipotle provides another example of competing on the basis of limited product complexity. In a recent article, Fortune Magazine noted that: “the Chipotle menu is limited to four core basics, but it offers a range of garnishes like salsa and cheese and guacamole that can produce scores of combinations. Chipotle serves neither dessert nor coffee (too complicated). There’s no ‘dollar menu’ or ‘limited time offers’ (too gimmicky). And While the Dulles Airport restaurant serves scrambled eggs for breakfast, Chipotle has declined to begin breakfast operations in any of its other 1,150 restaurants.” Chipotle’s approach also demonstrates the power of “versioning”, wherein a company sharply limits its core product line offering (to control costs and enhance quality), but still caters to varying consumer tastes with low cost add-ons and accessories which are simple to provide. Chipotle’s product line strategy was highly successful in the fast casual restaurant category, propelling the company's stock to grow nearly 40 percent per year during the first five years of this decade. But a series of food poisoning outbreaks in 2015 shook customer and shareholder confidence in the company's quality control processes, from which Chipotle has yet to fully recover. Less Can Be More Determining optimal product line strategy is not strictly an analytical exercise to be turned over to technocrats armed with elegant analytical models. While companies should certainly seek to selectively thin out non-performing product lines over time, a far more important strategic imperative is choosing the basis upon which your company wishes to compete: broad market coverage vs. targeted product superiority. For companies like In-N-Out Burger, Chipotle’s, Apple and many others, there is no such thing as a free lunch. These companies could not have consistently achieved product superiority without explicitly choosing to limit the range of their product offerings. When it comes to product line complexity, less can be more. |

Len ShermanAfter 40 years in management consulting and venture capital, I joined the faculty of Columbia Business School, teaching courses in business strategy and corporate entrepreneurship Categories

All

Archives by title

How MIT Dragged Uber Through Public Relations Hell Is Softbank Uber's Savior? Why Can't Uber Make Money? Looking For Growth In All The Wrong Places Three Management Ideas That Need to Die Wells Fargo and the Lobster In the Pot Jumping to the Wrong Conclusions on the AT&T/Time Warner Merger What Kind Of Products Are You Really Selling? What Shakespeare Thinks About Brian Williams Are Customer-Friendly CEO’s Bad for Business? Uncharted Waters: What to Make Of Amazon’s Chronic Lack of Profits What Happens When David Becomes Goliath…Are Large Corporations Destined To Fail? Advice to Publishers: Don’t Fight For Your Honor, Fight For Your Lives! Amazon should be viewed as a fierce competitor in its dispute with publisher Hachette Men (And Women) Behaving Badly Why some brands “just don’t get no respect!” Courage and Faustian Bargains Sun Tzu and the Art of Disrupting Higher Education Nobody Cares What You Think! Product Complexity: Less Can Be More Apple's Product Strategy: No News Is Good News Willful Suspension of Belief In The Book Publishing Industry Whither Higher Education Timing Is Everything Teachable Moments -- The Curious Case of JC Penney What Dogs Can Teach Us About Business Are You Ready For Big-Bang Disruption? When Being Good Isn’t Good Enough Is Apple Losing Its Mojo? Blowing Up Old Habits What Is Apple's Product Strategy--Strategic Rigidity or Enlightened Expansion Strategic Inertia Strategic Alignment Strategic Clarity Archives by date

March 2018

|

Proudly powered by Weebly

RSS Feed

RSS Feed