|

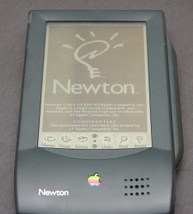

A former chief technology officer of Hewlett-Packard recently shared the profound observation with me that “the difference between a good idea and a great one is timing.” So true. While (too) much attention is often given to the dangers of being late to market — as HP assuredly was with its ill-fated and short-lived tablet computer — it can be just as deadly to prematurely enter a market before the technology, cost, or operational requirements are ready to deliver a viable consumer value proposition. To put the issue of launch timing in context, recall that every new product launch must overcome three inherent risks to become a market success:

Another example of a great idea in theory, that failed to deliver an attractive value proposition, is the Segway. Hailed as a revolutionary product that would change the world when first introduced by inventor Dean Kaman in 2001, consumers never could figure out why a $3,000 motorized scooter (banned from operating on most big-city sidewalks) made any sense. The world may have changed over the past decade, but largely without the ubiquitous presence of Segways. Overcoming risks On a brighter note, it is possible to overcome initially negative market reactions to new product concepts, as some of the most successful current products (or those intriguingly on the horizon) demonstrate. Consider the following:

The reasons underlying Apple's success with the iPad have been well documented, including thoughtful design and UI, technical refinement (e.g. battery life, screen resolution), the availability of hundreds of thousands of apps and a huge installed base of step-up iPhone users. All of this boils down to great execution and timing. Steve Jobs had an uncanny sense of not only what, but when to introduce new technology.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Len ShermanAfter 40 years in management consulting and venture capital, I joined the faculty of Columbia Business School, teaching courses in business strategy and corporate entrepreneurship Categories

All

Archives by title

How MIT Dragged Uber Through Public Relations Hell Is Softbank Uber's Savior? Why Can't Uber Make Money? Looking For Growth In All The Wrong Places Three Management Ideas That Need to Die Wells Fargo and the Lobster In the Pot Jumping to the Wrong Conclusions on the AT&T/Time Warner Merger What Kind Of Products Are You Really Selling? What Shakespeare Thinks About Brian Williams Are Customer-Friendly CEO’s Bad for Business? Uncharted Waters: What to Make Of Amazon’s Chronic Lack of Profits What Happens When David Becomes Goliath…Are Large Corporations Destined To Fail? Advice to Publishers: Don’t Fight For Your Honor, Fight For Your Lives! Amazon should be viewed as a fierce competitor in its dispute with publisher Hachette Men (And Women) Behaving Badly Why some brands “just don’t get no respect!” Courage and Faustian Bargains Sun Tzu and the Art of Disrupting Higher Education Nobody Cares What You Think! Product Complexity: Less Can Be More Apple's Product Strategy: No News Is Good News Willful Suspension of Belief In The Book Publishing Industry Whither Higher Education Timing Is Everything Teachable Moments -- The Curious Case of JC Penney What Dogs Can Teach Us About Business Are You Ready For Big-Bang Disruption? When Being Good Isn’t Good Enough Is Apple Losing Its Mojo? Blowing Up Old Habits What Is Apple's Product Strategy--Strategic Rigidity or Enlightened Expansion Strategic Inertia Strategic Alignment Strategic Clarity Archives by date

March 2018

|

Proudly powered by Weebly

RSS Feed

RSS Feed